“Further evidence that a recession is not just possible but probable.”

The U.S. stock market may be at an all-time high, but the “Wall Street – Main Street disconnect” remains wider than ever — and that spells trouble ahead.

Specifically, there’s a dramatic difference in perspectives about the health of the U.S. economy. On the one hand is Wall Street celebrating the stock market’s new records, with many believing the Federal Reserve has avoided a recession by executing a “soft landing.”

Yet the average American is much more pessimistic. I receive numerous emails from readers describing significant and sudden slowdowns in their particular industries and widespread fears in their communities of how much worse it could become in coming months. And the data confirm what they’re saying.

One indicator that does a creditable job of capturing this disconnect is the difference between the Conference Board’s Consumer Confidence Index (CCI) and the University of Michigan’s Consumer Sentiment Index (UMI). The CCI more heavily reflects consumers’ attitudes toward the overall economy, and so is more strongly correlated with the stock market and news headlines about “soft landings” and the like. The UMI, in contrast, is more heavily weighted toward consumers’ immediate personal circumstances.

As you can see from the chart above, while this spread has narrowed slightly from its record high from a year ago, it nevertheless remains higher than ever historically. (Monthly data for the spread extend back to 1978.) The chart also shows U.S. recessions, shaded in gray, according to the calendar maintained by the National Bureau of Economic Research.

As you also can see, a recession soon occurred on each prior occasion when the spread began to retreat from a new high. While it’s entirely possible that the U.S. will avoid a recession this time around, we shouldn’t forget that the four most dangerous words in investing are “it’s different this time.”

James Stack, editor of the InvesTech Research newsletter, who tracks the spread between the CCI and the UMI, recently summarized the economic tea leaves by writing that “it looks like a disastrous train wreck waiting to happen.” He reminds us that in August 2007, just two months before that year’s bull-market high and four months before the beginning of the worst recession since the 1930s, Janet Yellen, then-president of the Federal Reserve Board of San Francisco and currently secretary of the Treasury, reported that the economy seems to be “on a glide path for the proverbial soft landing.” (Full disclosure: Stack’s newsletter is not one of those that pay a flat fee to have its performance audited by my firm’s performance-tracking service.)

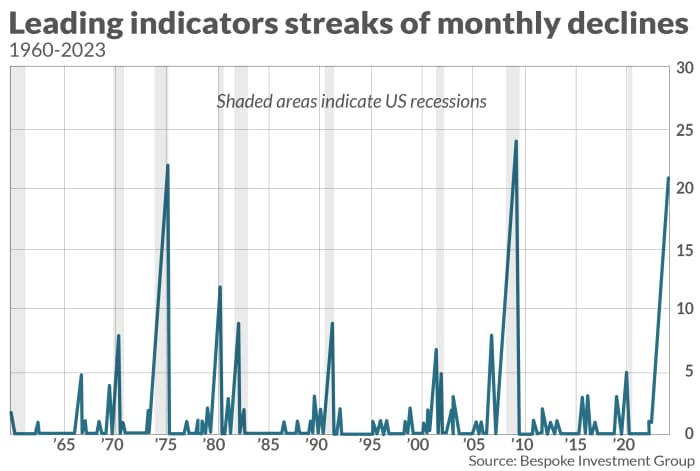

Further evidence that a recession is not just possible but probable comes from the Conference Board’s Index of Leading Economic Indicators (LEI). The latest reading of this index, released earlier this week, is the 21st month in a row in which the LEI has declined — the third-longest streak on record. A recession occurred after every other streak of similar magnitude, as you can see from the chart above, courtesy of data from Bespoke Investment Group.

The bottom line? It’s not healthy for Wall Street to be celebrating while so many individuals are gloomy.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com

More: Recession was inevitable, economists said. Here’s why they were wrong.

Also read: Here’s what big consumer-sentiment gains mean for the stock market — and this one is unusual

Source link